As part of our Data Dive series, we bring forward data-driven patterns and perspectives on international student recruitment. With the spotlight on Nigeria, a burgeoning powerhouse in international student mobility, the figures speak volumes about the emerging trends and opportunities. In this article, I will highlight the visa approval trends and rates and briefly discuss the case for investing in the Nigerian market.

With a growing population and an increasing demand for high-quality education, Nigerian students are actively seeking international opportunities, especially in major English-speaking countries. Additionally, leveraging Nigeria’s growing interest in international education offers a significant opportunity for Canadian institutions. This effort will not only diversify our campus but also enhance our global standing.

Why Nigeria?

- Youthful Population: Nigeria’s median age is approximately 18.1 years, indicating a large and growing pool of potential students.

- Population Growth: With over 200 million people, projected to double by 2050, Nigeria is a significant source of prospective students.

- Education Demand: The limited availability of local university spaces leads many Nigerians to seek education abroad.

- English Proficiency: As an English-speaking country, many Nigerian students are well-prepared for education in Canada.

- Investment in Education: Despite economic challenges, Nigerian families prioritize education, viewing international studies as a pathway to better opportunities.

Nigerian Student Mobility Trends:

Rising Student Numbers: Nigeria is a leading African nation for student mobility, with many students pursuing education abroad annually. In fact, notably, it’s the 11th top origin country for students in the U.S. as per the latest 2019/2020 data from the Institute of International Education (IIE).

Top Destinations: Nigerian students predominantly choose English-speaking countries like the U.S., UK, Canada, and Australia, attracted by their high-quality education, diverse academic programs, and post-graduation opportunities.

Caution!!! In all honesty, we can’t talk about Nigeria without talking about brain drain. Also, see this YouTube video on this topic: https://youtu.be/YYvLEbC3kn8?si=AbvBlGM5I8duRP5p. However, I am a strong believer that international education, if used correctly, helps many of the developing economies as well, be it with remittances or providing skill training to their youth.

Canada and Nigeria

Between 2017 and 2023, Nigerian annual visa approvals for study in Canada have skyrocketed by an astounding 1397%, dwarfing the overall increase of 158% for Canada. And this seismic shift indicates an undeniable upswing in Nigerian students’ interest in Canadian education. Visa approvals remain dismal but are up to 32% in 2023 as compared to 15% in 2017.

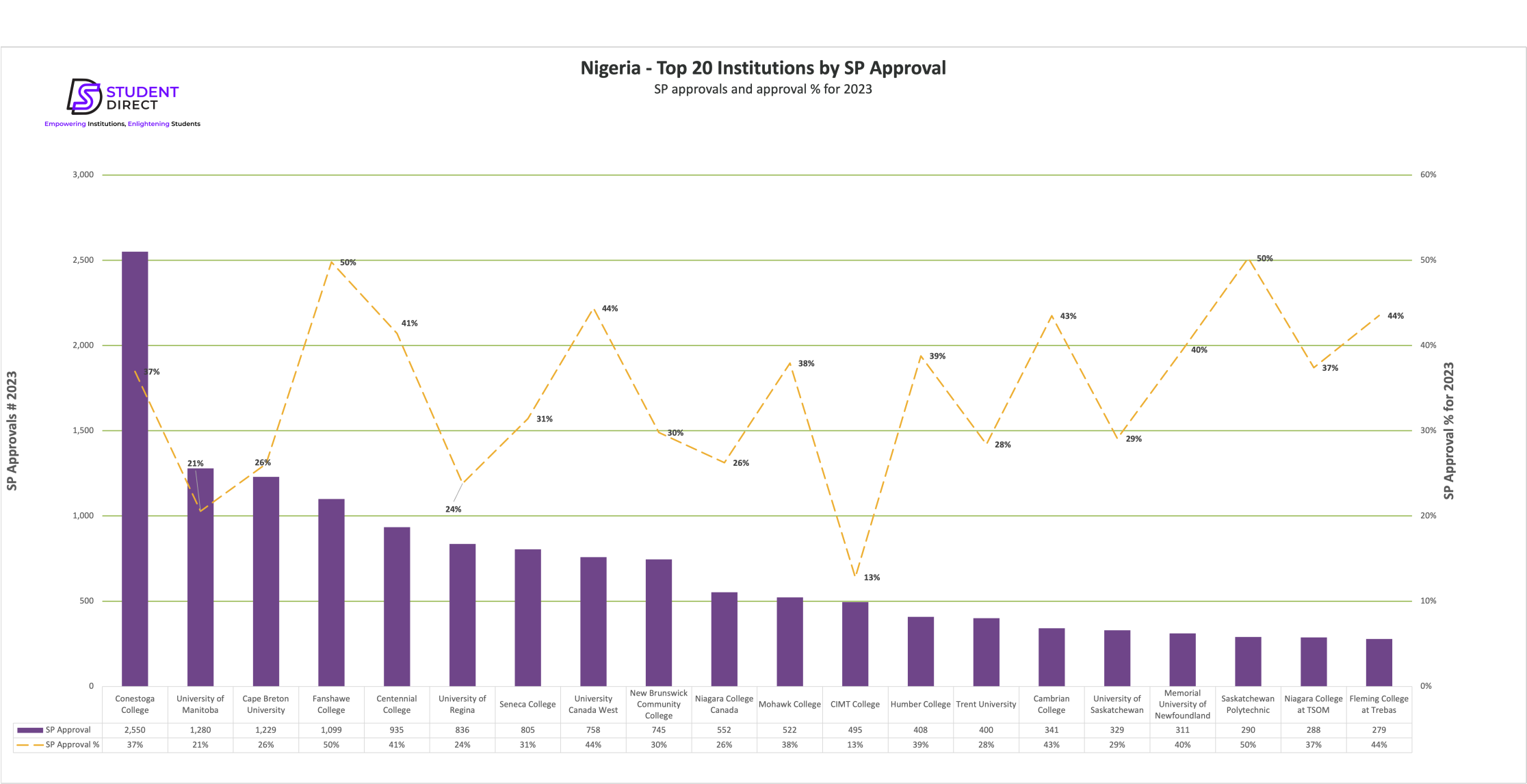

Here are the top institutions based on study permit approvals from Nigeria for 2023.

Top Institutions by Visa Approvals for 2023

(Institutions, Visa approvals and visa approval rate)

- Conestoga College, 2550, 37%

- University of Manitoba, 1280, 21%

- Cape Breton University, 1229, 26%

- Fanshawe College, 1009, 50%

- Centennial College, 935, 41%

- University of Regina, 836, 24%

- Seneca College, 805, 31%

- University of Canada West, 758, 44%

- NBCC, 745, 30%

- Niagara College, 553, 26%

Observations:

- The top 20 institutions account for almost 60% of visa approvals for Canada.

- 4 out of the top 10 institutions are Universities (3 public and 1 private). In fact, It is apparent that Nigeria is not only a market for colleges. It’s much more like India (in this sense), where there is a market for all levels of post-secondary education players.

- Most institutions suffer from a dismal approval rate, which is in line with the average of 32%, except for Fanshawe College, Centennial College and UCW. And I believe this is thanks to either fantastic filtering and admission processes (Fanshawe and Centennial) or conversion teams doing a lot of good work (UCW).

- Nigerian students are very value-conscious (no surprise there), which you can see from some of the top institutions that offer some of the most cost-effective fees.

- I am struck by 2 notable absences: a) Alberta institutions. University of Calgary comes first among Alberta (with Rank 23) b) Public BC institutions. TRU is the highest ranked public institution at Rank 22 (266 approvals, 50% approval rate)

Visa approvals have been a consistent challenge in Nigeria. Also, different stakeholders blame different things – fraud, lack of financial systems, and system-wide bias have been pointed out as reasons by some. But this has been looking up – approval rates have more than doubled in the last 6 years.

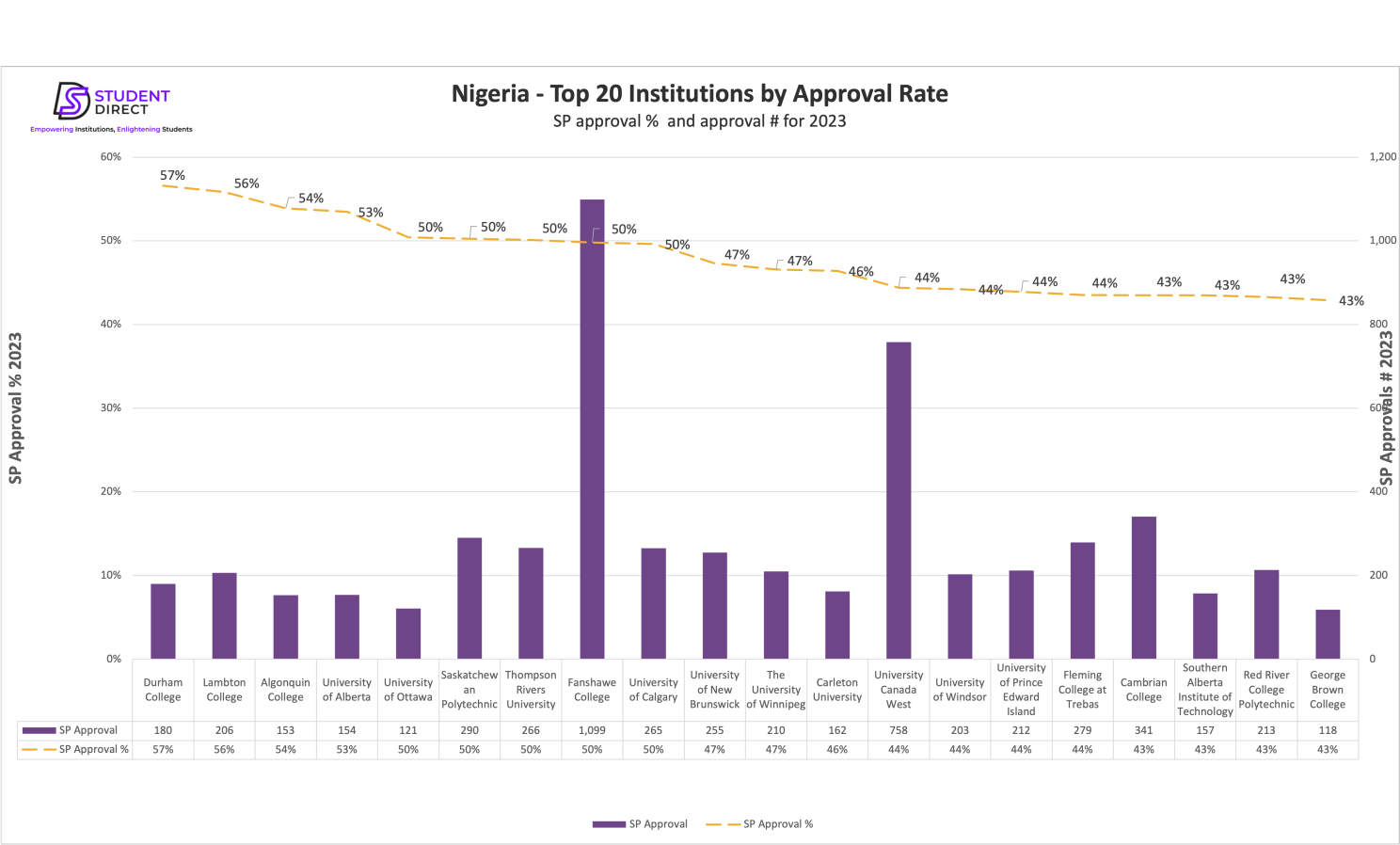

Top Institutions by Visa Approvals Rate for 2023 (for institutions with more than 100 approvals)

(Institutions, Visa approvals and visa approval rate)

- Durham College, 180, 57%

- Lambton College, 206, 56%

- Algonquin College, 153, 54%

- University of Alberta, 154, 53%

- University of Ottawa, 121, 50%

- Saskatchewan Polytechnic, 290, 50%

- Thompson Rivers University, 266, 50%

- Fanshawe College, 1099, 50%

- University of Calgary, 265, 50%

- University of New Brunswick, 255, 47%

Observations

- The top 20 institutions by approval rates are evenly split between Universities and Colleges (at 10 each).

- Durham and Lambton approval rates are impressive, with approval rates close to the Canadian average across the world (at 57% and 56% respectively).

- Most impressive on the list has to be Fanshawe College at Rank 8 (I know a thing or two about that based on my previous role) and UCW at Rank 13 (I am sure it’s a work of a fantastic conversion set-up) based on the volumes they are attracting.

Impact on recruitment

With the complexities that the forthcoming PAL process brings, many institutions might not exactly be able to focus on markets like Nigeria, which are promising but fraught with risks. But leveraging the growing interest of Nigerian students in international education presents a valuable opportunity for Canadian institutions. And by instilling the correct processes (for admissions and filtering) and tailoring our recruitment strategies, we can attract more Nigerian students to our institutions, thereby enriching our campus diversity and strengthening our global reputation.

If you would like to talk more about Nigeria and how it is possible to manage such a promising but risky market, feel free to contact me at saurabh@studentdirect.ca

References

- The data used is provided by IRCC on visa approvals and refusals since 2017. For this analysis, all PCPP numbers have not been counted under the public college (if separate data is provided by IRCC).

- Institute of International Education (IIE), “Open Doors Report on International Educational Exchange,”

- Canadian Bureau for International Education (CBIE), “Facts and Figures,”

- UK Council for International Student Affairs (UKCISA), “Statistics: International Students in the UK,”

- Australian Government, Department of Education, Skills and Employment, “International Student Data,”