In this edition of the Data Dive series, we unpack the dramatic decline in Canada’s student visa approvals from January to September 2024 compared to the same period in 2023. All data is based on a custom data set requested from IRCC.

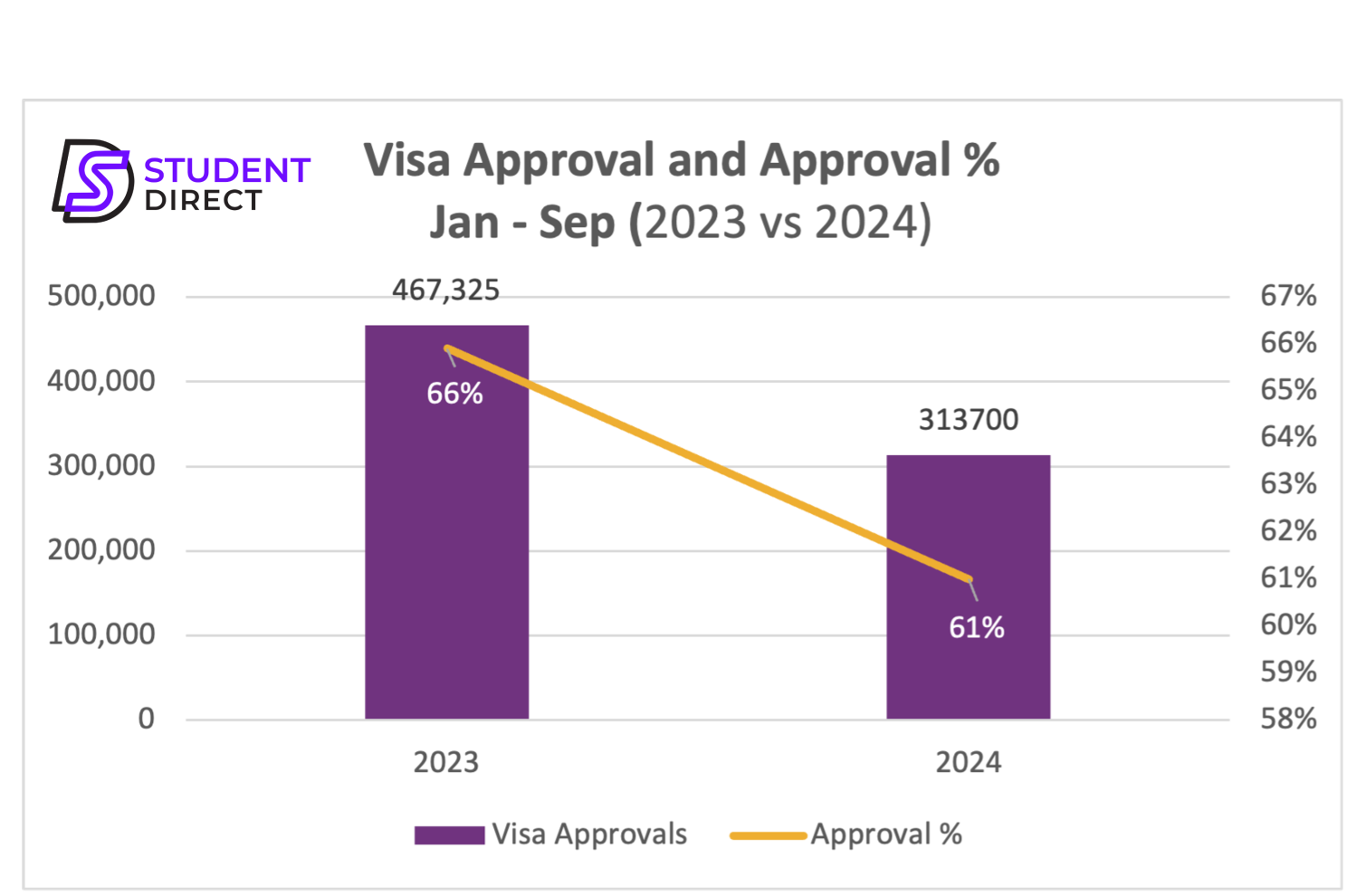

With a 33% drop in visa approvals (from 468,000 in Jan-Sept 2023 to 313,700 in Jan-Sept 2024), alongside a decline in approval rates from 66% to 61%, the Canadian international education industry is facing its most challenging year yet. While the government’s initial targets for reductions have already been exceeded, the full picture will likely worsen once October–December data becomes available. This trend is expected to carry into 2025.

Observations

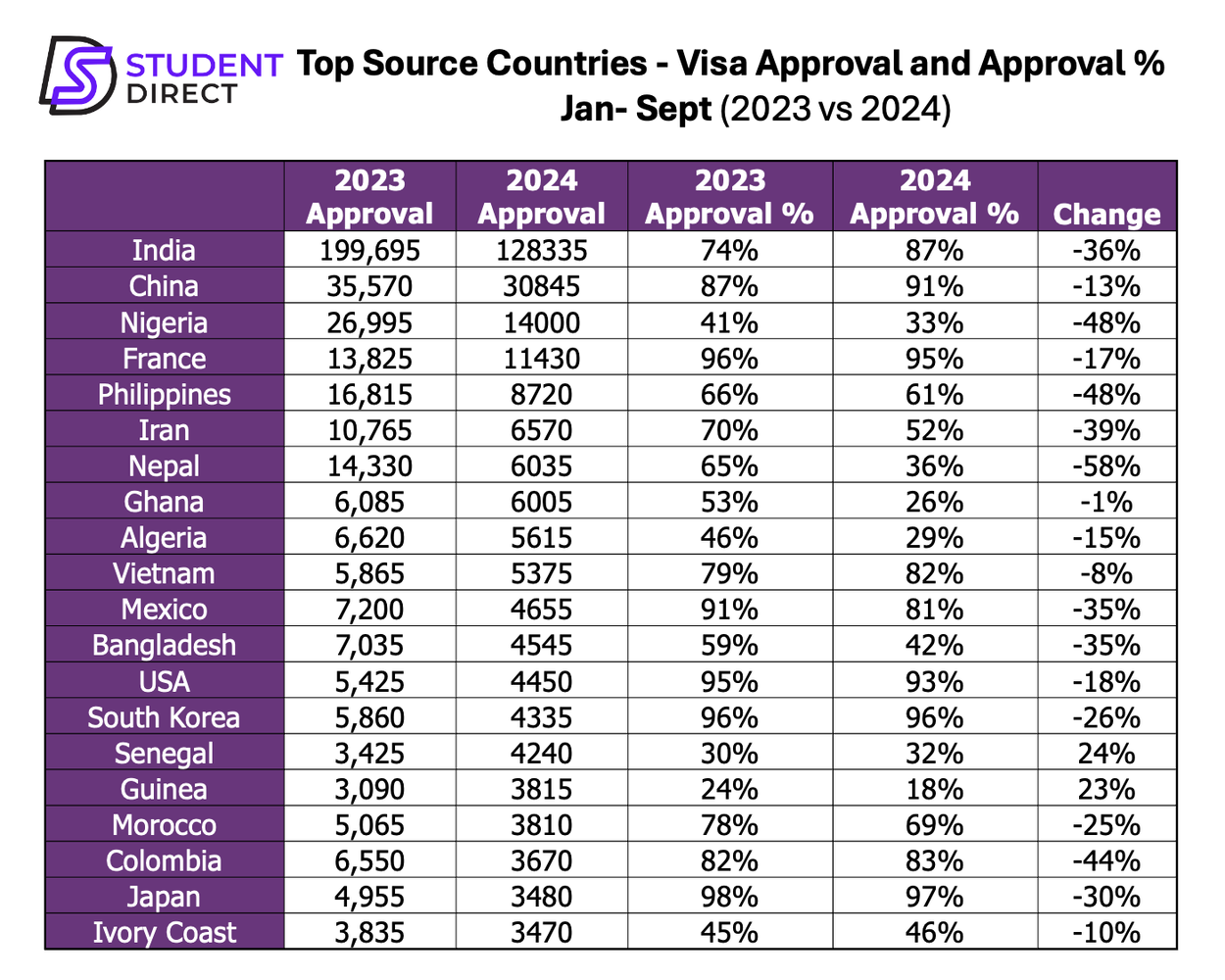

- India remains the top source country for Canada, despite a 36% decline in visa approvals. However, the visa approval rate appears to be increasing, with a notably high approval rate.

- China has shown weakness in the many years preceding 2024; however, in 2024, China seems to be holding strong and only falling by 13%. Approval rate also remains as strong as ever.

- Nigeria remains the third largest market but has almost halved from 2023. The visa approval rates have also fallen; however, these are higher than some estimates from earlier in 2024.

- French-speaking countries have shown a tremendous resilience, where France, Algeria, Morocco and Ivory Coast have fallen much less than the average and Senegal and Guinea have grown.

- Ghana is a big surprise with almost no decline in 2024 from 2023, along with Vietnam only declined by 8%.

- Major markets like Nepal, Iran, the Philippines and Colombia see a bigger decline than the average.

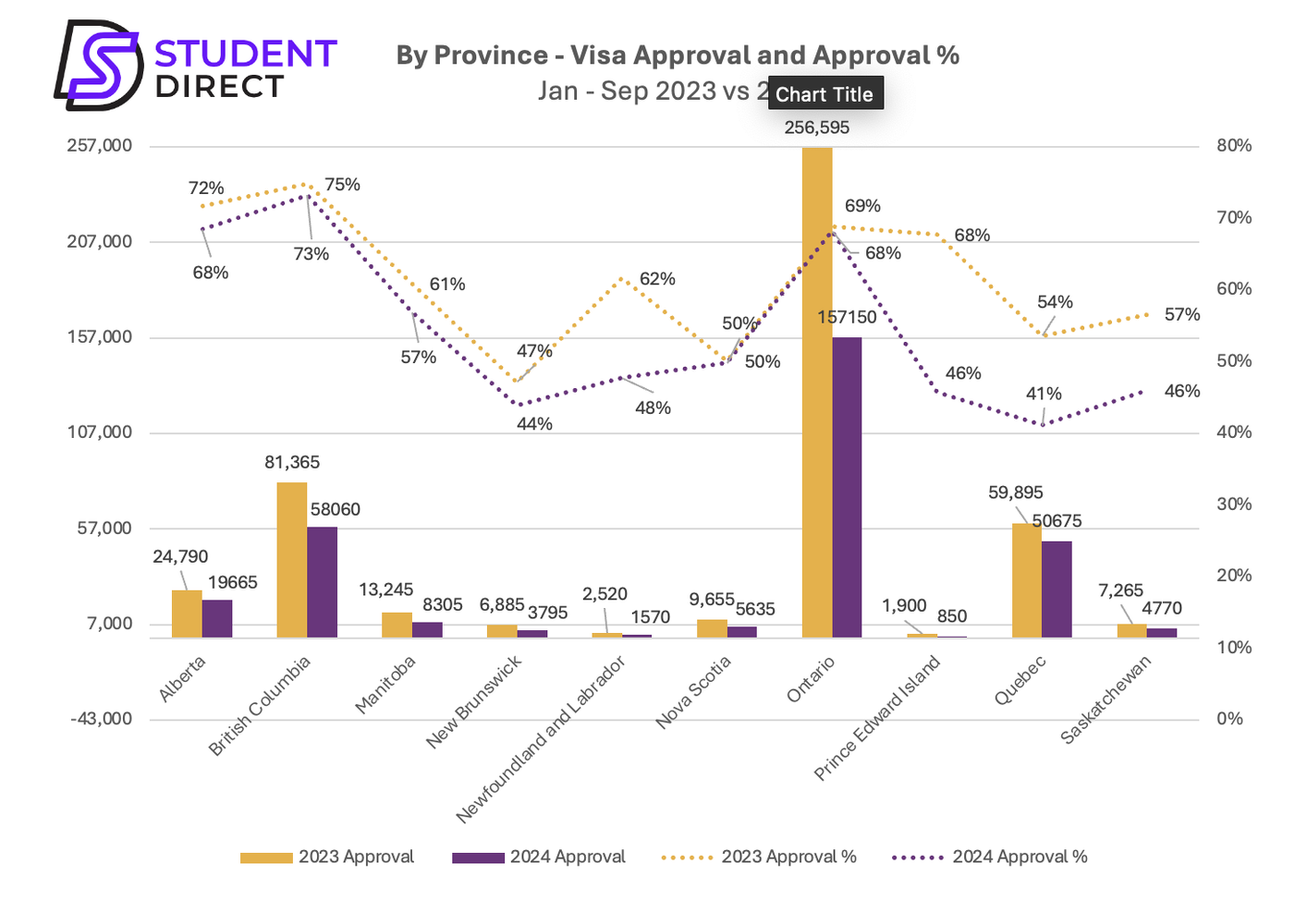

Biggest Declines in Approval Numbers: Ontario and British Columbia, being the largest markets, experienced the sharpest numerical declines.

Largest Approval Rate Drops: Prince Edward Island, Quebec, Newfoundland and Labrador and Saskatchewan show steep drops in approval rates.

Ontario:

- Visa approvals dropped from 256,595 in 2023 to 157,150 in 2024, representing a 38.7% decline.

- Approval rates remained stable at 68% in 2024 from 69% in 2024.

- As the largest recipient of international students, Ontario’s decline is a critical indicator of the challenges facing the Canadian International student program.

British Columbia:

- Visa approvals fell from 81,365 in 2023 to 58,060 in 2024, marking a 28.6% decline.

- The approval rate dropped marginally from 75% to 73%

- British Columbia remains a top destination but is showing the policy impact.

Quebec:

- Visa approvals decreased from 59,895 in 2023 to 50,675 in 2024, a 15.4% decline.

- The approval rate decreased significantly, from 54% in 2023 to 41% in 2024.

Alberta:

- Visa approvals dropped from 24,790 in 2023 to 19,665 in 2024, a 20.7% decline.

- Approval rates fell from 72% to 68%

Manitoba:

- Approvals decreased from 13,245 in 2023 to 8,305 in 2024, representing a 37.3% decline.

- Approval rates slightly decreased from 61% in 2023 to 57% in 2024.

Saskatchewan:

- Visa approvals dropped from 7,265 in 2023 to 4,770 in 2024, a 34.3% decline.

- Approval rates decreased from 57% to 46%

Nova Scotia:

- Approvals fell from 9,655 in 2023 to 5,635 in 2024, a 41.6% decline.

- Approval rates remained the same at 50%.

Prince Edward Island:

- Visa approvals dropped significantly from 1,900 in 2023 to 850 in 2024, a 55.3% decline.

- Approval rates declined from 68% to 46%, one of the steepest declines.

New Brunswick:

- Visa approvals decreased from 6,885 in 2023 to 3,795 in 2024, a 44.9% decline.

- Approval rates dropped from 47% to 44%.

Newfoundland and Labrador:

- Approvals dropped from 2,520 in 2023 to 1,570 in 2024, a 37.7% decline.

- Approval rates fell from 62% to 48%, mirroring trends seen across the Atlantic provinces.

Final Thoughts

The Canadian international education sector stands at a crossroads. While Canada student visa approvals for 2024’s data reveal a significant downturn, institutions have a chance to pivot their strategies, focusing on program realignment, direct engagement, trust-building, and market diversification. The path forward requires resilience, creativity, and a commitment to adapt to the new normal. The challenges are significant, but so too are the opportunities to reshape the narrative and rebuild for the future.